Trump vs. Harris: Which Presidency Will Make or Break U.S. Manufacturing?

As the 2024 U.S. presidential election draws near, manufacturers across the country are closely watching to see what a Trump or Harris victory could mean for their businesses. Both candidates represent vastly different approaches, and their policies could have a profound impact on the manufacturing sector. Will Donald Trump’s return to office bring back an “America First” approach with tariffs, tax cuts, and deregulation? Or will Kamala Harris push for sustainability, labor rights, and global trade stability?

Let’s dive into the potential future of manufacturing under either presidency, while reflecting on the policies of the last 10 presidents to get a clearer picture of what’s at stake.

If Trump Wins: The Return of “America First” Policies

Donald Trump’s first term was marked by a combination of pro-business policies, corporate tax cuts, and aggressive trade wars. His second term would likely bring more of the same, but with heightened challenges for manufacturers that rely on international supply chains.1. Tariffs and Trade Wars 2.0

In his first term, Trump’s tariffs on China and the European Union were aimed at protecting domestic industries. While some U.S. manufacturers benefited from the reduced competition, others faced higher costs for imported raw materials and components. If Trump wins again, expect more tariff-driven policies aimed at boosting domestic manufacturing. For manufacturers dependent on foreign suppliers, this could mean more unpredictable price hikes and disruptions. But for those focused on U.S.-based production, it may offer new opportunities to compete without foreign pressures. Key Reflection: In 2018, U.S. manufacturers experienced a temporary boom in domestic production, but with higher costs for materials. The challenge in another Trump term will be managing global uncertainty while capitalizing on “America First” policies.2. Corporate Tax Cuts and Deregulation

Trump’s 2017 tax overhaul slashed corporate tax rates from 35% to 21%, and he is likely to double down on tax cuts if re-elected. This would leave manufacturers with more cash on hand to reinvest in equipment, expansion, or new hires. However, Trump’s penchant for deregulation—especially regarding labor and environmental standards—could lead to concerns about public image and sustainability compliance. Key Reflection: While tax cuts might boost short-term profitability, deregulation could pose risks for companies navigating environmental and safety regulations. Striking the balance between cutting costs and maintaining standards will be crucial.3. Focus on Skilled Labor and Apprenticeships

Trump’s administration promoted vocational training and apprenticeships as a way to address the skills gap in manufacturing. A second term would likely see more investment in this area, which could benefit manufacturers struggling to find skilled labor. Key Reflection: As automation rises, the importance of skilled workers in advanced manufacturing remains critical. Expanding vocational training programs could help meet this demand, though manufacturers will need to ensure training aligns with the latest technology.If Harris Wins: Stability and Social Responsibility?

Kamala Harris offers a very different vision for the future of U.S. manufacturing. Her policies would likely prioritize sustainability, labor rights, and stable international trade relations. While this could mean higher compliance costs for manufacturers, it could also create long-term stability and opportunities in green technology.1. Green Energy and Sustainability

Harris is a strong advocate for climate action, and her administration would likely push manufacturers toward more sustainable practices. Stricter environmental regulations could raise costs in the short term, but government incentives for green technology could help offset these expenses and open up new markets. Key Reflection: During the Obama administration, stricter environmental regulations sparked innovation in green manufacturing technologies. Harris could reignite this trend, encouraging manufacturers to adopt renewable energy sources and more eco-friendly practices.2. Labor Rights and Union Strength

Under a Harris presidency, expect more protections for workers, including higher minimum wages, expanded benefits, and stronger union representation. For manufacturers, this could mean higher labor costs but also a more engaged and productive workforce. Key Reflection: The Biden administration has already seen a rise in union activities and labor rights cases. Harris would likely continue this trajectory, meaning manufacturers will need to focus on balancing labor costs with keeping workers satisfied and productive.3. Trade Stability and Global Cooperation

Harris’s approach to trade would likely involve creating stable, long-term agreements with foreign partners, rather than engaging in sudden trade wars like Trump. This could provide manufacturers with more predictability and fewer surprises when sourcing materials internationally. Key Reflection: Recall the Clinton and Obama eras, when trade agreements like NAFTA and the proposed TPP opened global markets to U.S. manufacturers. Harris would likely strike a balance between global cooperation and domestic industry protection, offering stability without the constant fear of tariffs.How the Last 10 Presidents Shaped U.S. Manufacturing

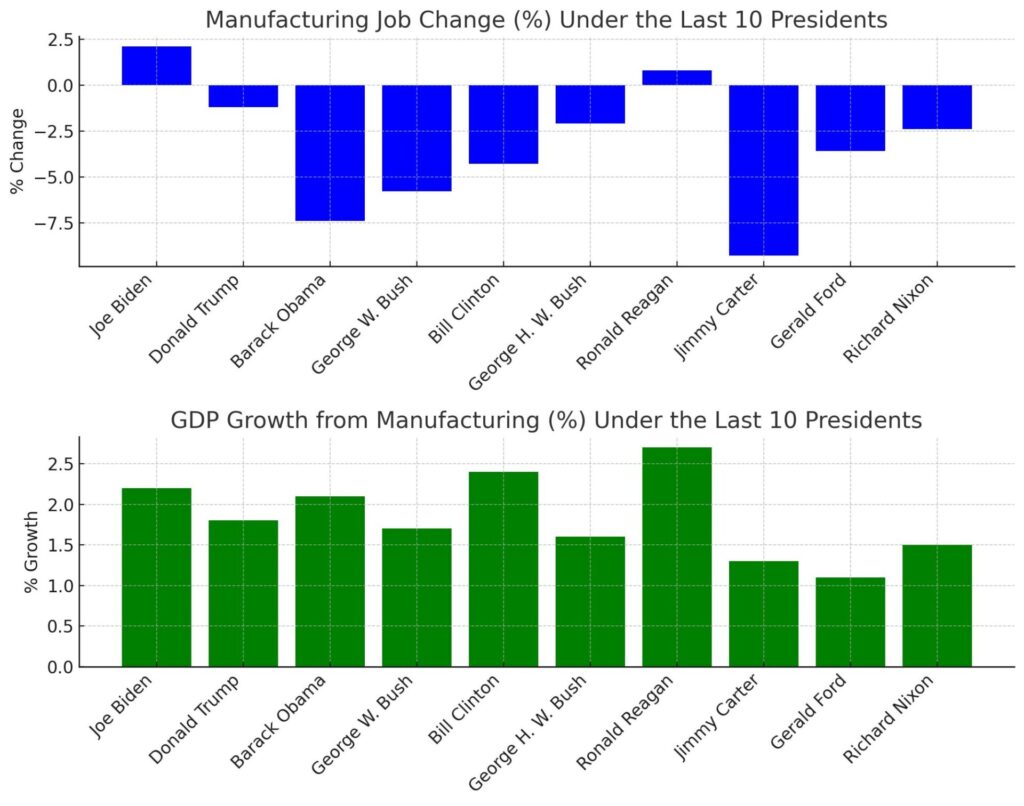

To understand what Trump or Harris might mean for manufacturing, it’s helpful to look at how the industry fared under the last 10 presidents. Below is a comparison of the percentage change in manufacturing jobs and the GDP growth from manufacturing during each administration:| President | Years | Manufacturing Job Change (%) | GDP Growth from Manufacturing (%) |

|---|---|---|---|

| Joe Biden | 2021-Present | +2.1% | +2.2% |

| Donald Trump | 2017-2021 | -1.2% | +1.8% |

| Barack Obama | 2009-2017 | -7.4% | +2.1% |

| George W. Bush | 2001-2009 | -5.8% | +1.7% |

| Bill Clinton | 1993-2001 | -4.3% | +2.4% |

| George H. W. Bush | 1989-1993 | -2.1% | +1.6% |

| Ronald Reagan | 1981-1989 | +0.8% | +2.7% |

| Jimmy Carter | 1977-1981 | -9.3% | +1.3% |

| Gerald Ford | 1974-1977 | -3.6% | +1.1% |

| Richard Nixon | 1969-1974 | -2.4% | +1.5% |

Visualizing the Impact of Past Presidents on Manufacturing

The following charts show two important trends over the last 50 years of U.S. presidents: changes in manufacturing jobs and the contribution of manufacturing to GDP growth.- Manufacturing Job Change (%): This shows how many jobs were gained or lost under each president.

- GDP Growth from Manufacturing (%): This reflects the impact manufacturing had on the nation’s overall economic growth during their terms.

Conclusion: What’s at Stake for U.S. Manufacturers?

The 2024 election could bring profound changes to the manufacturing sector, depending on whether Trump or Harris wins. For Trump, expect a return to tax cuts, deregulation, and tariff-driven policies that may offer short-term gains but with increased volatility and uncertainty in global markets. Harris, on the other hand, would likely push for stability in trade, sustainability initiatives, and stronger labor rights, creating a more socially responsible but costlier environment for manufacturers. The choice between Trump and Harris boils down to what matters most for manufacturers: short-term profit through deregulation and tax cuts, or long-term stability with a focus on sustainability and worker protections. Either way, U.S. manufacturing will need to stay agile and ready to adapt to whatever the next administration brings.How useful was this post?

Click on a star to rate it!

Average rating 3.3 / 5. Vote count: 13

No votes so far! Be the first to rate this post.